A look at the rise and rise of sensor use and of virtual healthcare services.

IDTechEx* has released a report on the market for electronic skin patches. The report captures the impact of the COVID-19 pandemic as well as the broader emerging trends across the relevant product sectors.

Having covered the subject over the last decade as part of wider research efforts in wearables and medical devices, this report looked at each of the key market sectors involved. Diabetes management is the largest and most successful sector, predominantly with CGM but also increasing adoption of patch pumps for insulin delivery and moves towards closed-loop systems.

Cardiovascular monitoring is the other sector generating revenue in the billions of dollars each year but is far more fragmented in terms of players, product trends, and geographies. These skin patch cardiovascular monitors are increasingly at the centre of an expansion to a more general approach to patient monitoring, both for hospital inpatients and beyond into various outpatient applications. Other sectors such as temperature-based monitoring (fever monitoring, fertility monitoring), electrical stimulation devices, iontophoresis (a treatment for excessive sweating), and other patient monitoring devices are also covered in the report.

On the impact of Covid-19, James Hayward, Principal Analyst at IDTechEx and lead author of the report, said, “Rather than any lasting negative impact as seen elsewhere, the pandemic has led to an acceleration in many of the key trends underpinning the development of this market. Wider adoption of telehealth, additional drivers for remote patient monitoring, and larger-scale adoption of digital patient management solutions were all trends which we covered previously, but the acceleration in each has left us two years ahead of our original projections for their widespread adoption.”

Telehealth

The report says that initial lockdowns caused a significant negative impact in many sectors due to the postponement of ’non-essential’ physician visits. However, many companies immediately shifted to more telehealth-based services which helped to meet the demand. In addition, regulatory barriers were lowered, allowing many products to receive emergency approvals and advance their commercialization and deployment faster than they would normally have been able to. This then extended to larger companies with more ambitious aims around general remote patient monitoring and management using digital systems, which have been in development for some time but saw more launches and announcements as progress accelerated.

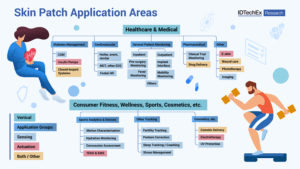

The report makes it clear that electronic skin patches as a product category is extremely diverse. There are different drivers, regulatory situations, and underlying trends in many of the different markets where skin patches are relevant. Each product sector has a drastically different set of drivers, competitive landscape and outlook, and skin patch-based options fit within each in a very unique way.

Virtual care

Another report by MEDTECHDIVE says, ‘CGM and insulin pump players look to 2021 as watershed year for diabetes wearables market with the recent skyrocketing of virtual care due to the coronavirus pandemic. Patients embraced devices like continuous glucose monitors and insulin pumps in recent years before the pandemic, and companies in these markets like Dexcom and Insulet or Medtronic and Abbott Laboratories have remained successful despite the economic volatility throughout 2020.” To read the full report, CLICK HERE.